Key Takeaways

- You are not legally required to give a recorded statement to the other driver's insurance: Politely decline and direct all questions to your attorney.

- Adjusters use 7 common traps to minimize your claim: Open-ended questions, health status questions, and friendly rapport are all designed to lock you into statements that can be used against you.

- Anything you say becomes the "truth" for the insurance company: If later facts contradict your initial statement — which is likely when you didn't have full information — you look inconsistent to a jury.

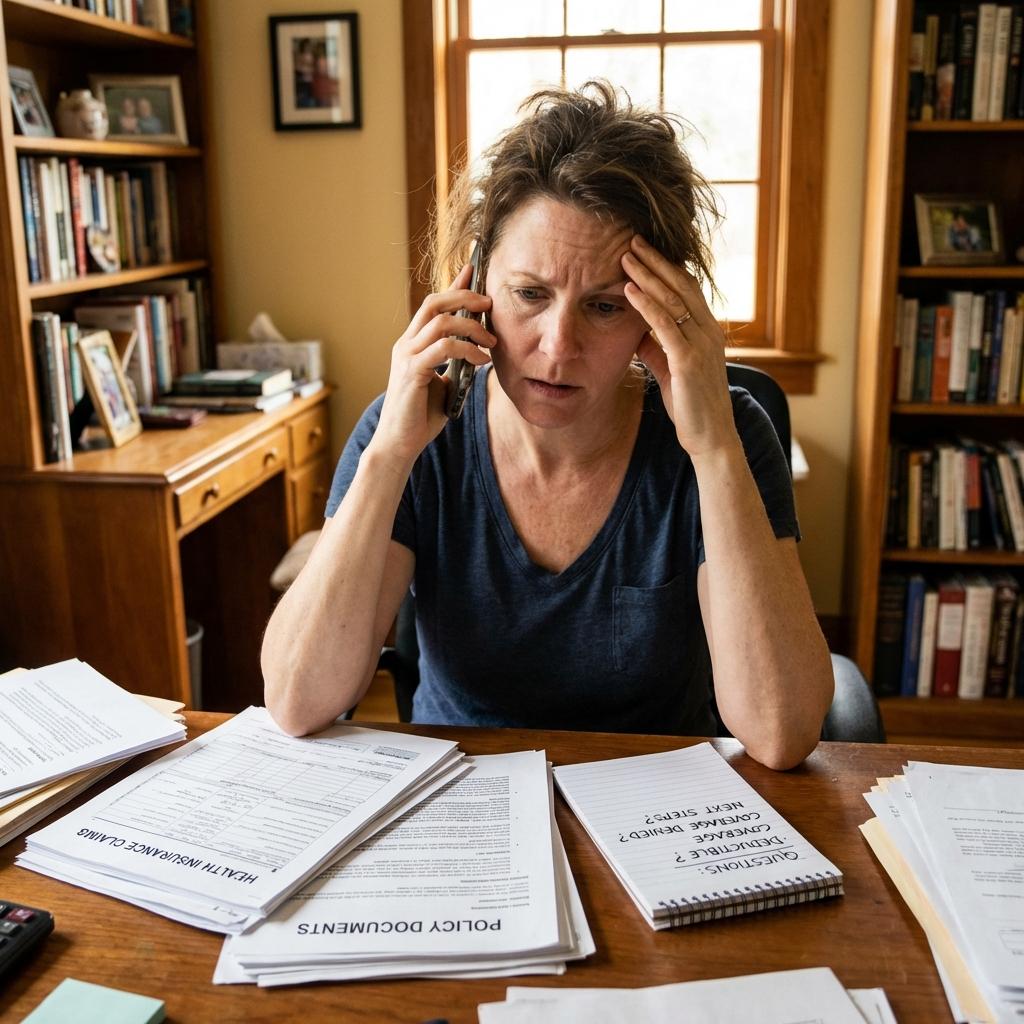

Within days of your car accident, you'll get a call from an insurance adjuster. They'll be friendly, sympathetic, and eager to "get your side of the story." They'll ask if you mind if they record the conversation — just for accuracy, of course.

Don't fall for it.

That recorded statement is designed to help the insurance company deny or minimize your claim. Every word you say will be analyzed for ways to use it against you.

Why Adjusters Want Recorded Statements

Insurance companies aren't gathering information to help you. They're building a case file to:

- Find inconsistencies they can exploit

- Lock you into positions before you know the full extent of your injuries

- Capture admissions that reduce or eliminate your claim

- Create evidence to use against you at trial

You're under no legal obligation to give a recorded statement to the other driver's insurance company. Oklahoma's insurance bad faith statute, 36 O.S. § 3629, requires insurers to deal fairly with claimants — but that obligation doesn't require you to provide recorded testimony that can be weaponized against your own interests. For your own insurer, policy terms may require cooperation, but even then, you have protections and should consult an attorney before making any recorded statements.

Trap #1: "Just Tell Me What Happened"

This open-ended question seems innocent. But in the minutes after impact, you didn't have complete information. You don't know:

- What the other driver did before the collision

- Whether witnesses saw something you didn't

- What physical evidence exists

- How your injuries will develop

Anything you say becomes your locked-in version of events—even if additional facts later emerge that would help your case.

The trap: Your incomplete account becomes the "truth" against which all later evidence is measured. If new facts contradict your initial statement, you look inconsistent.

Trap #2: "How Are You Feeling Today?"

This question exploits the fact that many injuries don't fully manifest for days or weeks. Soft tissue injuries, traumatic brain injuries, and internal damage often worsen over time.

If you say "I'm doing okay" or "just a little sore," that statement follows you forever. When you later report serious pain or limitations, the insurance company points to your recorded statement: "But you said you were fine."

The trap: Locking in your condition before you know the extent of your injuries.

Trap #3: "Were You Paying Attention?"

Adjusters ask questions designed to elicit admissions about your own conduct:

- "Were you looking at your phone?"

- "How fast were you going?"

- "Did you see the other car before impact?"

- "Could you have done anything to avoid it?"

Any answer can be twisted. If you say you didn't see the other car, that's used to argue you weren't paying attention. If you say you did see it, they'll ask why you didn't react sooner.

The trap: Getting you to admit comparative fault that reduces your recovery.

Trap #4: "Do You Have Any Prior Injuries?"

This question is designed to attribute your current injuries to pre-existing conditions rather than the accident. The adjuster will later obtain your medical records and compare them to your statement.

If you fail to mention a prior back issue, neck problem, or previous accident, you look like you're hiding something. If you do mention them, those become the "real" cause of your current pain.

The trap: Creating a basis to deny that your injuries were caused by this accident.

Trap #5: "Can You Describe Your Medical Treatment?"

Adjusters want you to describe your treatment in your own words—so they can later argue you're exaggerating or that your account doesn't match medical records.

They'll also probe for gaps in treatment. If you took two weeks off from physical therapy, they'll argue your injuries weren't serious enough to require consistent care.

The trap: Finding inconsistencies between your statement and medical records.

Trap #6: "What Are Your Injuries Preventing You From Doing?"

Another question designed to lock you into a position before you know the full scope of your limitations.

If you say you can still do most things, that undercuts future claims about how the injury affected your life. If you claim total disability, your social media and surveillance footage will be compared to that claim.

The trap: Creating a baseline they can use to minimize your damages.

Trap #7: The Friendly Relationship

Perhaps the most dangerous trap is the adjuster's demeanor itself. They're trained to be warm, understanding, and sympathetic. They want you to let your guard down and speak freely.

This isn't genuine concern—it's a technique. The adjuster is not your friend. Their job is to pay you as little as possible.

The trap: Making you comfortable enough to say things you shouldn't.

What You Should Do Instead

For the Other Driver's Insurance

You're not required to give them a recorded statement. Politely decline:

"I'm not comfortable giving a recorded statement at this time. Please direct any questions to my attorney."

If you don't have an attorney yet, it's still fine to decline. You can always provide information later.

For Your Own Insurance

Your policy may require "cooperation," but this doesn't mean answering every question however they want. You can:

- Request questions in writing so you can provide accurate answers

- Have your attorney present during any recorded statement

- Limit the scope to relevant information

- Decline to speculate or guess

Before Any Statement

If you must give a statement:

- Wait until you know your injuries — Don't rush

- Review the facts carefully — What do you actually know vs. assume?

- Stick to facts — Don't speculate, guess, or theorize

- It's okay to say "I don't know" — Much better than guessing

- Get legal advice first — An attorney can prepare you for what's coming

We Protect Our Clients

One of the first things we do for new clients is handle all insurance communications. This means:

- No more adjuster phone calls

- No recorded statements without preparation

- Professional responses to information requests

- Protection against traps and manipulation

If you've been injured in an accident and you're getting calls from insurance adjusters, contact us before speaking with them. A free consultation can help you understand your rights and avoid mistakes that damage your claim.

Frequently Asked Questions

Am I legally required to give a recorded statement to the other driver's insurance?

No. You have no legal obligation to give a recorded statement to the at-fault driver's insurance company. They may pressure you, but you can politely decline and direct all communications to your attorney. This is one of the most important steps you can take to protect your claim.

What if my own insurance company asks for a recorded statement?

Your own policy may require "cooperation," which can include providing statements. However, you still have protections: you can request questions in writing, have your attorney present, and decline to speculate or guess. An attorney can review your specific policy language to advise you on your obligations.

Can the insurance company use my recorded statement against me in court?

Yes. Recorded statements are admissible evidence. Insurance companies routinely use them to impeach plaintiffs at trial — pointing out inconsistencies between your initial statement and your later testimony or medical records. This is precisely why they want the statement as early as possible, before you know the full picture.

What should I say if an adjuster calls me after an accident?

Keep it short: confirm the accident happened, provide your basic contact information, and decline to give a recorded statement or discuss details. Say "I'm not comfortable discussing the specifics at this time" or "Please contact my attorney." Do not discuss your injuries, fault, or what happened.

How soon after an accident will the insurance adjuster call?

Often within 24 to 72 hours. Insurance companies move quickly because they know you're still in shock, don't have full information about your injuries, and haven't had time to consult an attorney. The earlier they get your statement, the more useful it is to them.

What if I already gave a recorded statement — can it be undone?

Unfortunately, once a statement is given, it cannot be retracted. However, an experienced attorney can help manage the impact by clarifying or contextualizing your statements, obtaining additional evidence that supports your claim, and preparing you for how the insurance company may use your words at trial.